Ctc Refund Dates 2025. The irs began processing returns on january 22, 2025, with most electronically filed returns expected to be processed within 21 days. According to the irs refunds will generally be paid within 21 days.

2025 Tax Refund Calendar 2025 Calendar Printable, Irs tax refund schedule dates. 27 for taxpayers who have filed and.

2025 Tax Refund Calendar 2025 Calendar Printable, The refundable portion is called the additional child tax credit, and this year the refundable amount is $1,600. 27 for taxpayers who have filed and.

IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, PATH ACT, One will receive the payment in the tax year 2025 itself. These credits will be provided to all the.

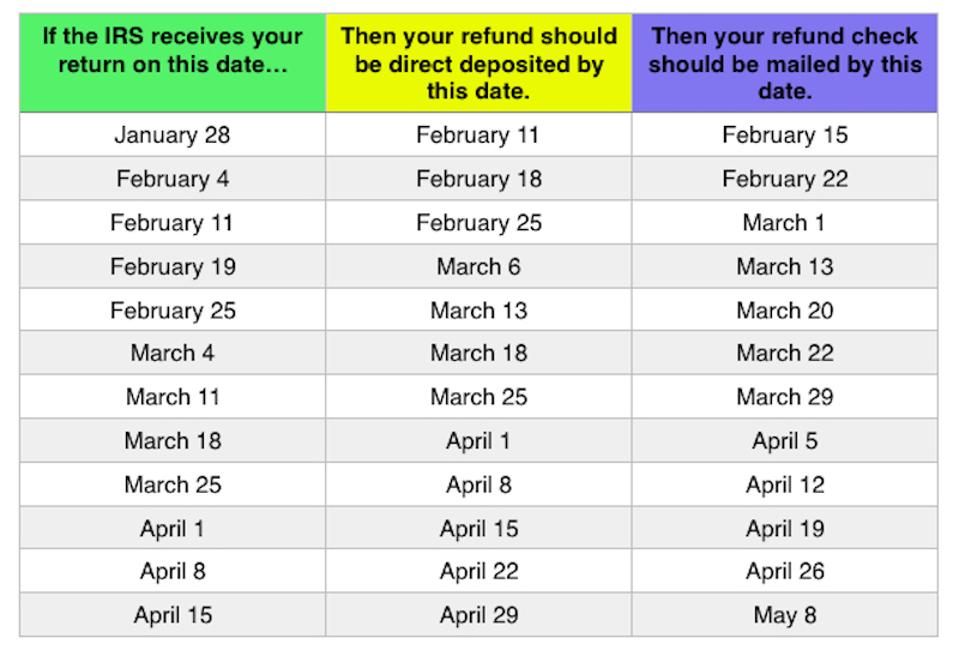

IRS Refund Schedule 2025 When To Expect Your Tax Refund, For the 2025 tax year, eligible. The irs has provided a schedule detailing the refund dates based on the approval date of the tax return:

Irs Updates On Refunds 2025 Nerty Tiphanie, This includes accepting, processing and disbursing approved refund payments via direct deposit or check. Taxpayers who filed their refund may anticipate payout dates within 10 to 14 days after the approval by the internal revenue service.

Refund Cycle Chart Online Refund Status, On january 19, 2025, the house ways and means committee approved the tax relief for american families and workers act of 2025. The maximum actc tax credit 2025 amount which will be provided to the citizens is $2000.

Tax refund 2025 PATH ACT Update for 2025 CTC and EITC refund payments, The deadline to file returns in 2025 is april 15 (this sometimes varies based on weekends or state holidays). 27 for taxpayers who have filed and.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, On january 19, 2025, the house ways and means committee approved the tax relief for american families and workers act of 2025. You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000.

When Can I Expect My Tax Refund? Premium Services, Keep in mind that the tax deadline will be back to the normal april 15, 2025 (except for residents of maine and massachusetts, due to state holidays on april 15, their. Another funding deadline, scoring the ctc proposal.

IRS Refund Schedule 2025 Tax Return Calendar, Efile & Onpaper Date, You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000. This article includes a handy reference chart taxpayers can use.

The refundable portion is called the additional child tax credit, and this year the refundable amount is $1,600.